Organizations are navigating unprecedented levels of uncertainty. The business landscape is now...

Offering Penetration (Adoption) Defined

Offering Penetration or -adoption gives a view of the depth of customer collaboration.

We work with mid-cap and large companies that often have divisions/subsidiaries/business groups and measure penetration at this higher level as well as offering level.

Higher offering penetration has multitude of benefits:

- Higher ARPA (average revenue per account/year) – read more about ARPA in our blog here

- Higher LTV (Life time value over the entire customer relationship which could last years and decades)

- Stronger Retention or loyalty

Offering is another thing to define also, which we approach with "Jobs-to-be-done" ideology.

Our customers may have a multitude of services or products meeting the same customer needs, which means that in order to simplify and make the data readable and understandable, an offering is a collection of SKUs of billing lines serving the same need. This approach allows us to discover what needs customers have and whether the company is already addressing them or if they remain in the potential side. Once we have mapped hundreds or thousands billing lines in to "offerings", we have a view to customers and what needs we are currently serving for them and which we are not (see "Potential).

WHY IS IT IMPORTANT TO UNDERSTAND AND ANALYSE PENETRATION LEVEL?

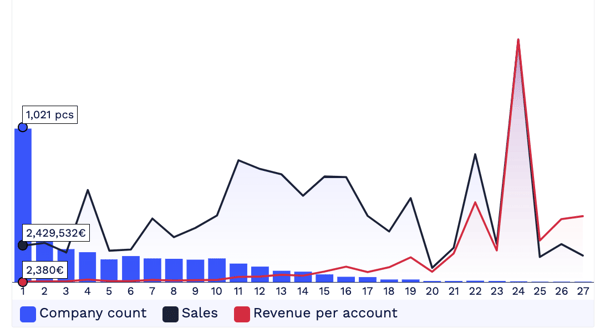

In this example, there is a regular view to what penetration level looks like.

The majority of customers (1,021 pcs) only use one single offering, and they contribute 2,43M€ in revenue (rolling 12 months). The average revenue per account (ARPA) is 2380€.

However, the majority of turnover comes from a much smaller number of customers using 11 or more offerings. The companies that have a stronger penetration, naturally have higher ARPA, stronger customer relationships and less risk of defect. Penetration is a measure of how deeply are we serving our customers and how strong a retention do we have with them.

This example graph is very a usual organic outcome in majority of businesses. The companies are well-known for some areas they operate in and those areas dominate the market penetration = most customers are using those offerings. Some customers, however, have discovered that the company's other offerings provide synergies and higher value for them and they are using a much wider portfolio.

Most companies have not mapped these synergies and solution spaces against customers' jobs-to-be-done. By doing this analysis carefully, you are likely to discover hard-to-copy competitive advantages that you already have, and scale. The fastest route to profitable growth is available by making most of what you already have. In this time of uncertainty, when productivity is an imperative, these discoveries are priceless. This is about Outcome Driven Innovation (ODI) on steroids.

INSIGHTS FROM PENETRATION ANALYSIS

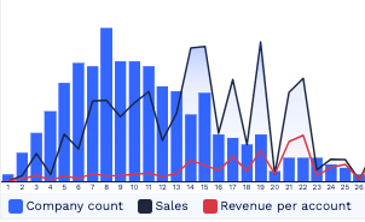

When you analyze penetration, there will be very valuable insights available for you to find. Here's an example of such.

Some offerings have "Halo-effect", which means that they promote a stronger penetration and make it easier for customers to buy and use wider offering base. These offering should be introduced to new customers as early as possible, because they will make the value experience, adoption and ARPA growth faster.

Penetration has strong variation by offering or customer segments. Some business sectors have adopted behaviors that include stronger penetration levels, while others use 1-2 offerings.

This analysis gives you tools to ask completely new questions, plan and design:

- Recognize, analyse and research customers that have high penetration and how their relationships have developed over time. These customers represent current success stories that can be communicated with clarity and value for the masses. Understanding how things have evolved, why and what value customers gain from this behavior is a source of bottom-up insights and innovation.

- Offering analysis on which offerings represent accelerators and which represent islands. From offering management point of view, the insights are very concrete and valuable.

- Which offerings appear most frequently together? Even if the company has not built solutions by combining multiple offerings together, smart customers have already adopted those behaviors and benefit from them. In most cases we can recognize wider customer needs and jobs-to-be-done that can be met by combining multiple offerings into solutions. These solutions often represent competitive advantage and differentiation in the market place. They can be very strategic and valuable insights.

DESIGNING RELATIONSHIPS AND COMPETITIVE ADVANTAGE

When companies are designing individual offerings, they carefully research and analyse the customers' needs and how to fulfil them. However, at the overall enterprise level this is rather rare. Looking at all strategic segments and full capacity of variety of offerings, it is actually quite rare that the company would have a solid plan on how they could maximally deliver value and competitive advantage for their customers.

Penetration level is both indicator and analysis tool as well as strategic KPI. Driving penetration deeper is both growth strategy and Risk mitigation.

The Service Design thinking has moved on to Business Design and we are now entering the "Customer Relationship Design" era, that is founded on strategic segmentation and striving to drive deeper, longer and more profitable customer relationships and competitive advantage founded on companies' full portfolio wide capacity to solve customers' challenges.

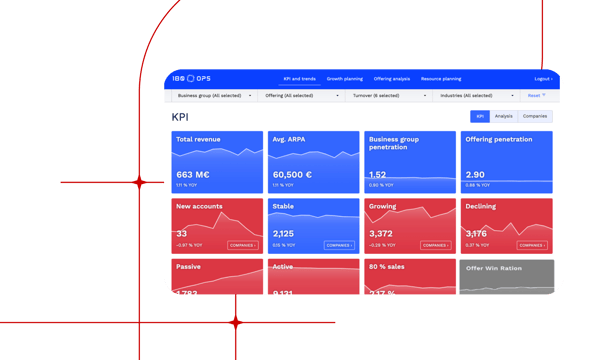

Here's how Penetration is present in the KPI dashboard in our 180ops tool.